Generally in the cash receipts journal to debit columns for cash receipts and cash discount and three credit columns for accounts receivable, sales and other accounts are there. Cash received from various sources other than cash sales and account receivables are recorded in other accounts column. Thegeneral journalis the all-purpose journal that all transactions are recorded in. Since all transactions are recorded in the general journal, it can be extremely large and make finding information about specific transactions difficult. That is why the general journal is divided up into smaller journals like the sales journal, cash receipts journal, and purchases journal.

- Credit sales and sales made on account are not usually recorded in this journal because there isn’t any cash collected in these transactions.

- The source documents for the Sales journal are copies of all invoices given to the debtors.

- As these accounts are posted, the account number is entered into the post reference column.

Cash and Discount Columns

When a retailer/wholesaler sells goods to a customer, and it collects cash, this transaction is recorded in the accounting software for small business of 2022. In our example, the only other credit column featured in the cash receipts journal is for all other accounts. It is set up in the same way that the other column on the debit side is, except that the account title area is replaced by a “Ref.” column. As the example shows, a typical cash receipts journal consists of many columns.

Record Retention Guidelines

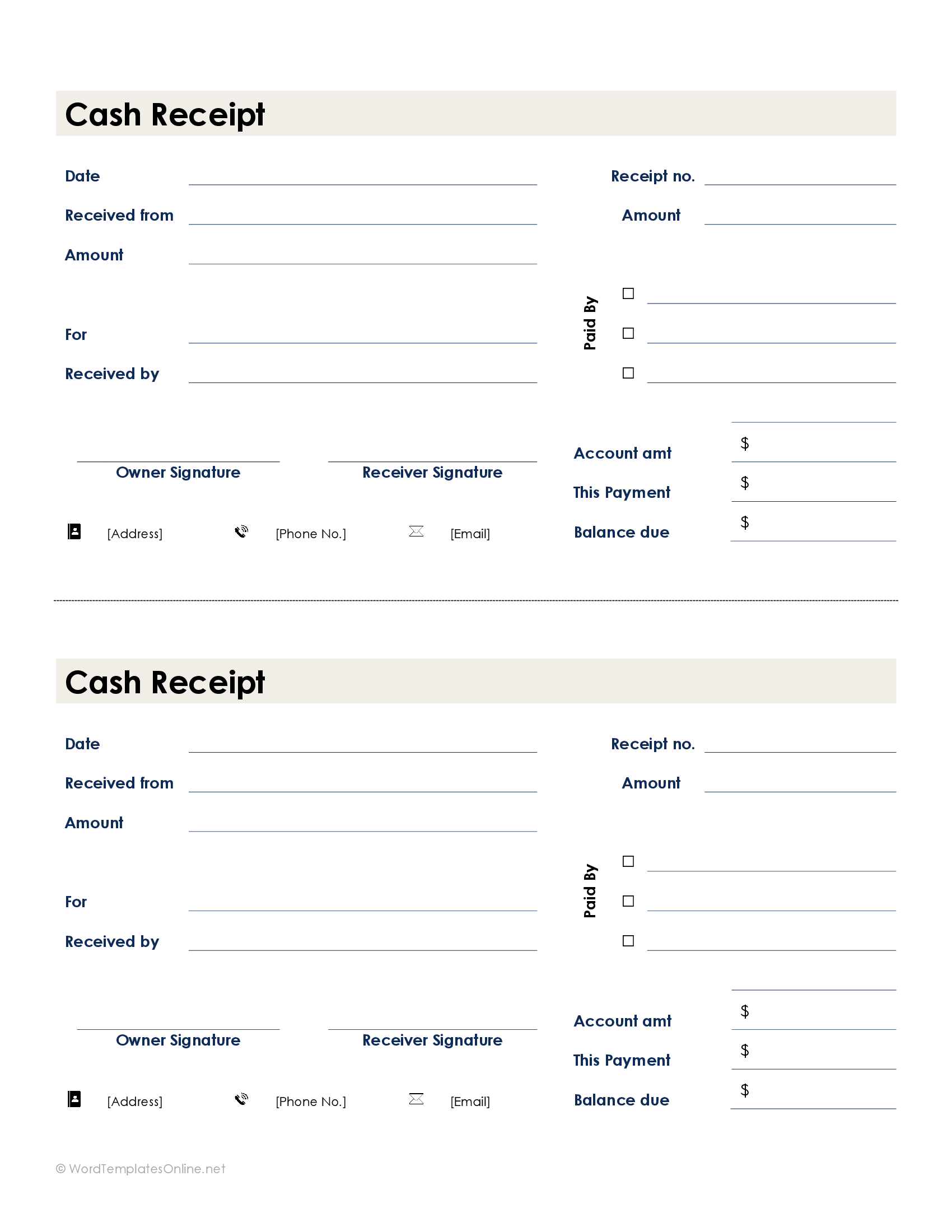

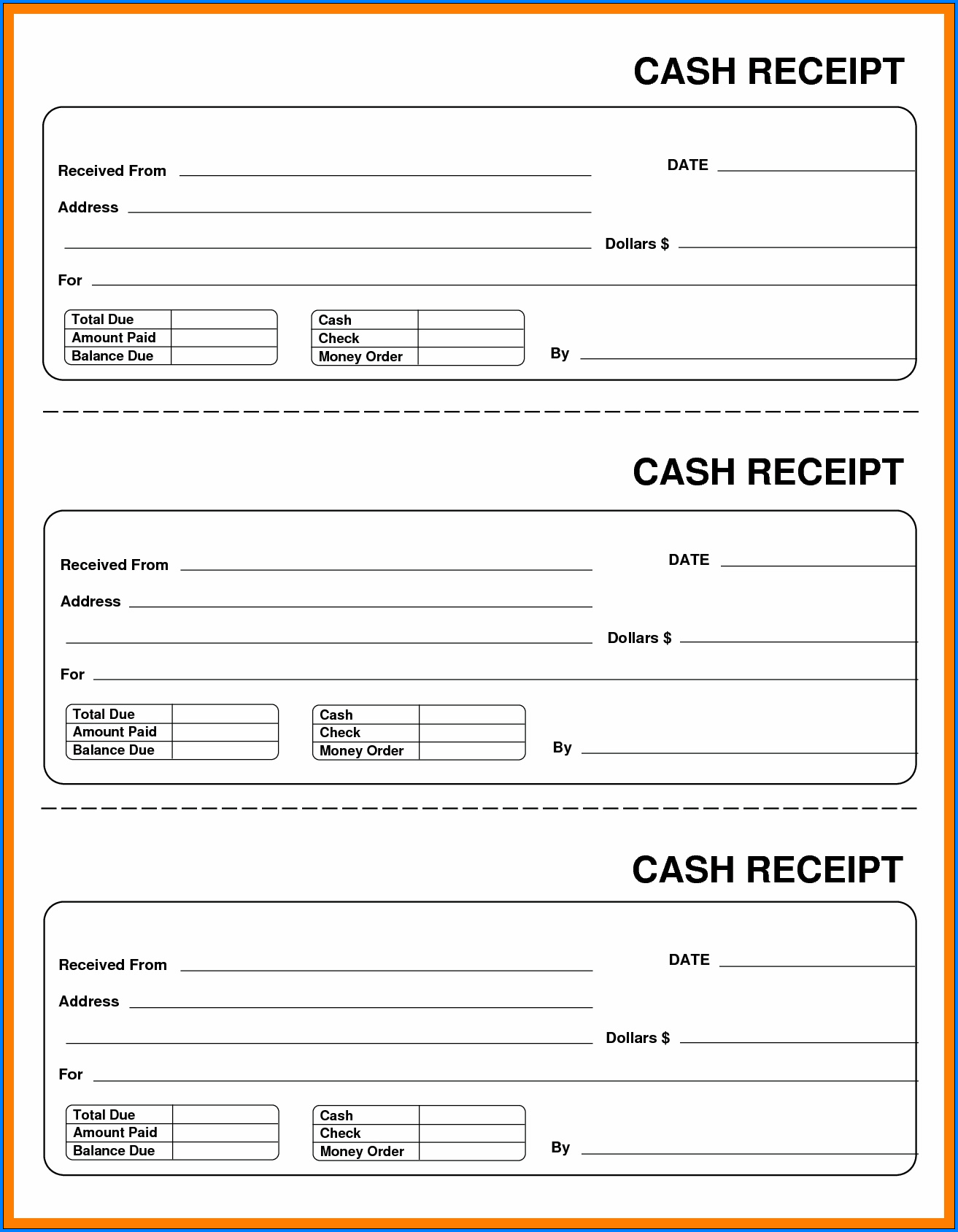

The cash receipt is then allocated to the appropriate revenue account, such as sales or service fees, or applied against a customer’s accounts receivable balance if it’s a payment for an earlier invoice. A cash receipts journal is a specialized accounting journal used to record and track all cash inflows received by a business. This journal helps businesses organize and maintain a detailed record of cash transactions, providing an overview of the sources of cash and the amounts received during a specific period. At the end of June, the business totals each column to update its general ledger accounts. The cash receipts journal helps the business track its cash inflows, identify the sources of cash, and maintain accurate financial records. All cash receipts for a given accounting period are recorded in the cash receipts journal, a special kind of accounting journal.

Time Value of Money

This is necessary because there are numerous transactions that lead to the receipt of cash. Again, the three column cash ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book. Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit). Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit) . If someone needs to investigate a specific cash receipt, they might begin at the general ledger and then move down to the cash receipts journal, from which they might obtain a reference to the specific receipt.

Bookkeeping

And that is that it only takes into consideration the cash basis of accounting. The cash receipts journal is used to track transactions where a shop or wholesaler sells products to a customer and receives payment in cash. Whenever a company receives cash for any reason, the journal entry is recorded in the cash receipts journal. Other sources of cash often include banks, interest received from investments, and sales of non-inventory assets. When a business gets a loan from a bank, the transaction to record the loan is made in the cash collections journal.

Ask Any Financial Question

The total from each column in a cash receipts journal is posted to the appropriate general ledger account. In addition, the post reference “cr” is recorded to indicate that these entries came from the cash receipts journal. Again, in the general ledger accounts, the post reference “CR-8” is recorded to indicate that these entries came from page 8 of the cash receipts journal. At the end of the month, the different columns in the cash receipts journal are totaled.

Regularly, an overall sum of the journal balance is calculated and sent to the general ledger. When looking into a specific cash receipt, a person would start with the general ledger before descending to the cash receipts log, where they might find a reference to the particular receipt. Depending on the nature of the business involved the two columns can be used for different purposes. The cash book is updated from original accounting source documents, and is therefore a book of prime entry and as such, can be classified as a special journal. There may be a large number of entries into this journal, depending on the frequency of cash receipts from customers.

For this reason the entries in the journal are not part of the double entry posting. Alternatively the business can use the additional column of the two column cashbook ledger to operate as a bank journal. The first three columns are the same as the single column cashbook and show the date, transaction description (Desc.), and ledger folio reference (LF). The two columns referred to in the name of this cashbook are the monetary amount of the cash receipt (Cash), and the monetary amount of the discount allowed (Discount) both highlighted in gray. The cash receipts journal is that type of accounting journal that is only used to record all cash receipts during an accounting period and works on the golden rule of accounting – debit what comes in and credits what goes out.