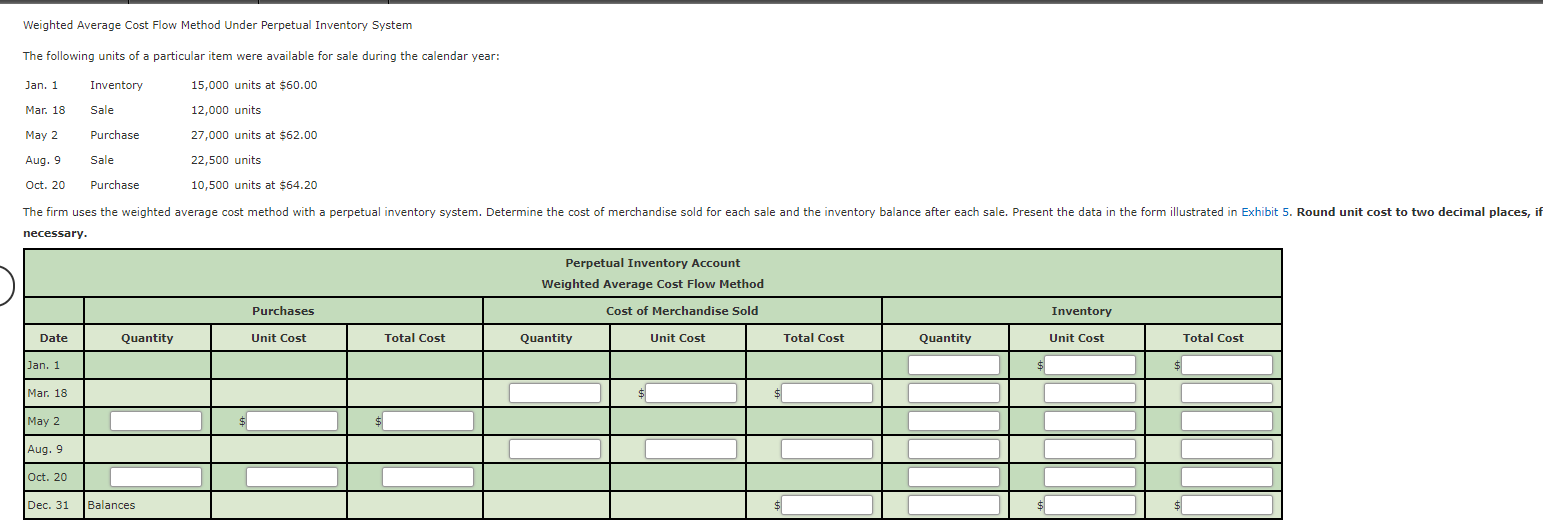

In a perpetual system, the inventory account changes with every transaction. Companies debit their inventory account with the cost of the merchandise each time they purchase or produce inventory and when they sell inventory to customers. The perpetual inventory software updates the inventory account with each transaction. The three cost flow assumptions that businesses use for this are FIFO, LIFO, and the Weighted Average Cost (WAC).

COGS

It will instinctively generate a purchase order for 500 more widgets and the system will automatically send this purchase order to your supplier. The COGS factors in those expenses such as overheads, warehouse, labour, and manufacturing costs that are directly related to the production of inventory stock. You will have ongoing, accurate results if you properly manage your perpetual inventory by updating it on a regular basis. Perpetual inventory system allows you to identify when the stock is running out and gives accurate information about inventory value and COGS. These allow you to investigate theft, discrepancies, shrinkage and even count errors immediately and adjust the records accordingly. You can analyze historical inventory and sales data to forecast upcoming sales cycles and ensure you have the correct inventory quantity.

Perpetual vs. periodic inventory systems

- Through a barcode scanner, the POS system calculates the price of the item and updates the inventory count to show that the item is sold.

- Whenever an item or SKU hits its reorder point, the system generates a new purchase order and sends it to your supplier with no human intervention.

- Since updates occur in real-time, businesses can promptly address any inconsistencies that may arise.

- The only reason businesses use the periodic inventory system is when they deal with high volumes of low-value products or when the amount of inventory is so small that a visual review is sufficient.

- A perpetual inventory system allows for quick identification and resolution of issues such as stock discrepancies or data entry errors.

- In a periodic inventory system, the COGS gets calculated at the end of an accounting period after you’ve completed a physical inventory count.

Differences could occur due to mismanagement,shrinkage, damage, or outdated merchandise. Shrinkage is a termused when inventory or other assets disappear without anidentifiable reason, such as theft. For a perpetual inventorysystem, the adjusting entry to show this difference follows.

Difference Between Perpetual Inventory System and Periodic Inventory System

Under the perpetual inventory system, an entity continually updates its inventory records in real time. The software can always provide the COGS in a perpetual inventory system as it maintains a running tally of transactions. In a periodic inventory system, the COGS gets calculated at the end of an accounting period after you’ve completed a physical inventory count. A periodic inventory system is kept up to date by a physical count of goods on hand at specific intervals to calculate COGS using inventory valuation methods such as FIFO, LIFO, and weighted averages. With a periodic inventory system, retailers calculate current inventory counts at the end of an accounting period or financial year and only then report on it.

What Is the Difference Between Perpetual and Periodic Inventory Systems?

These businesses have fast-moving inventory and process a high volume of returns and exchanges. A perpetual inventory system would handle the large volume of inventory transactions and provide real-time stock availability updates. The weighted tax relief services and consultations average cost method is the simplest to apply, plus you cannot manipulate income as easily as the other perpetual inventory methods. Sometimes accountants and stock controllers may need to adjust inventory levels using a manual journal entry.

Systems

When a company uses the perpetual inventorysystem and makes a purchase, they will automatically update theMerchandise Inventory account. Under a periodic inventory system,Purchases will be updated, while Merchandise Inventory will remainunchanged until the company counts and verifies its inventorybalance. This count and verification typically occur at the end ofthe annual accounting period, which is often on December 31 of theyear. The Merchandise Inventory account balance is reported on thebalance sheet while the Purchases account is reported on the IncomeStatement when using the periodic inventory method.

As product businesses grow, the number of SKUs and complications typically grow too. At a certain point, manual inventory management becomes no longer feasible. Periodically compare your accounting books to on-hand inventory to ensure your inventory balances are correct. Some pros of perpetual inventory include its ability to provide up-to-date inventory information instantly, its easy access system, and how it reduces the requirement to count physical inventory. The record accuracy it brings to other systems is a crucial benefit of having a perpetual inventory system. For instance, customer care representatives may now provide consumers with precise shipping availability information.

Since a perpetual system increases inventory record accuracy, the materials management staff can rely on the resulting on-hand balance information. Instead, inventory levels can be pared down, resulting in a smaller inventory investment. The use of a perpetual inventory system makes it particularly easy for a company to use the economic order quantity (EOQ) method to purchase inventory. EOQ is a formula that managers use to decide when to purchase inventory based on the cost to hold inventory as well as the firm’s cost to order inventory. To calculate inventory, companies need to set up a system where every piece of inventory is entered into the system and deducted from the system as it’s sold.

A large business with many products or a company that wants the ability to scale an emerging business over time would use a perpetual inventory system. Perpetual and periodic systems require different tools and procedures around how employees document inventory, although they can be complementary. In a periodic system, employees record products only at specified intervals. The perpetual inventory system assigns a unique tracking code to each product, allowing for continuous updating of inventory counts as goods are bought and sold.