On the other hand, a higher DSO can indicate potential cash flow problems and inefficiencies in the collection process. Regular monitoring and analysis of these ratios can provide valuable insights, enabling property managers to make informed decisions and implement corrective measures when necessary. Another sophisticated method involves integrating artificial intelligence (AI) into the receivables management process. rent receivable journal entry AI-driven chatbots can handle routine tenant inquiries about rent payments, freeing up human resources for more complex tasks. These chatbots can also send automated reminders and follow-ups, ensuring that tenants are consistently aware of their payment obligations. Additionally, AI can analyze historical data to recommend optimal times for sending payment reminders, maximizing the likelihood of timely payments.

How is rent expense presented in the financial statements?

If cash payments are not made at the same time as expense is recognized, the obligation to pay the amounts that have been expensed would be accrued. For a full explanation with journal entries, read our blog, Accrued Rent Accounting under ASC 842 Explained. If a business owns a property that is not being used then it may decide to rent it out and collect periodical payments as rent. Such a receipt is often treated as an indirect income and recorded in the books with a journal entry for rent received. Rent receivable is fundamentally tied to the contractual agreements between landlords and tenants. These agreements outline the terms under which rent is to be paid, including the amount, due dates, and any conditions that might affect payment.

Accounting for variable/contingent rent

Since the rent expense is an average, there will be months where cash is more than the straight-line expense and correspondingly months where cash is less than the expense. Deferred rent occurs in periods where the expense incurred is greater than cash paid for rent. The additional rent expense is “delayed” or deferred to be recognized at a later date. The accrued rent receivable account is considered a current asset, since rent is typically due within the next year. A landlord could offset this receivable with an allowance for doubtful accounts, if there is a probability that a tenant will not pay rent.

- Another important ratio influenced by rent receivables is the days sales outstanding (DSO).

- This involves estimating the future cash flows expected from the impaired receivable and discounting them to their present value.

- An elevated expense for doubtful accounts reduces net income, potentially affecting profitability metrics and investor perceptions.

- This can be assumed because straight-line rent expense is the average of all required payments.

- The monthly rent for the office space is $5,000, payable on the 5th of the following month.

- Late fees serve as a deterrent against delayed payments, while early payment discounts incentivize tenants to pay before the due date.

Rent Expense Explained and an Example of Straight-Line Rent under US GAAP

Although the deferred rent account used under ASC 840 is eliminated under ASC 842, the difference between the straight-line rent expense and the cash paid is still reflected on a company’s books. Under ASC 842, the net activity in the lease liability and ROU asset accounts each month is essentially deferred rent. In practice, lease payments are not typically disbursed at a constant amount, even if they are recognized in that manner.

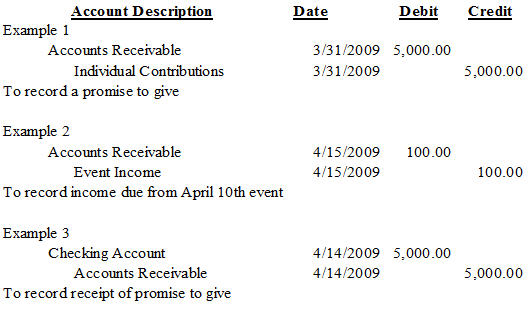

Accounting for accrued rent with journal entries

Another strategy to enhance cash flow is the implementation of late fees and early payment discounts. Late fees serve as a deterrent against delayed payments, while early payment discounts incentivize tenants to pay before the due date. Both approaches can accelerate cash inflows, providing a more stable financial footing. When lease terms are renegotiated, it may necessitate remeasuring the rent receivable and adjusting the related accounts.

In an operating lease, rent receivable is typically recorded as income over the lease term, reflecting the periodic payments made by the lessee. Conversely, in a finance lease, the lessor recognizes a net investment in the lease, which includes the present value of future lease payments. This distinction is crucial as it affects how rent receivable is reported and managed. Proper accounting of rent receivables helps to accurately track rental income for the landlord and provides an accurate picture of the landlord’s financial position.

For example, if you require tenants to make rent payments on the first of each month, you must increase the rent receivable or accrued rent account to reflect the payment you expect to receive from the tenant. Under ASC 842 base rent is included in the establishment of the lease liability and ROU asset. The amortization of the lease liability and the depreciation of the ROU asset are combined to make up the straight-line lease expense. Similarly to ASC 840, this straight-line lease expense is calculated as the sum of all of the rent payments over the lease term and divided by the total number of periods. A full example with journal entries of accounting for an operating lease under ASC 842 can be found here.

Consistent with the matching principle of accounting, when the rent period does occur, the tenant will relieve the asset and record the expense. A typical scenario with prepaid rent is mailing the rent check early so the landlord receives it by the due date. A similar adjustment will be made for any deferred rent expense at the transition to ASC 842. If deferred rent has a credit balance, the balance will be cleared with a debit and the offsetting credit will be recorded to the appropriate ROU asset. Conversely, if deferred rent has a debit balance at transition, a credit to deferred rent and an offsetting debit to the ROU asset will be recorded.

With this journal entry, the accumulated deferred rent is removed from a standalone account to become part of the new ROU asset. Not every organization will have an identical presentation, but rent expense is now widely referred to as lease expense on the income statement. As stated previously, the rent payments for operating leases under ASC 840 were expensed and therefore considered off-balance-sheet transactions. This would be beneficial for lessees as organizations did not have to report a liability on the balance sheet for the obligation. However, not reporting the obligation on the balance sheet may make the organization’s overall commitments appear drastically lower, depending on the significance of that entity’s operating lease portfolio.