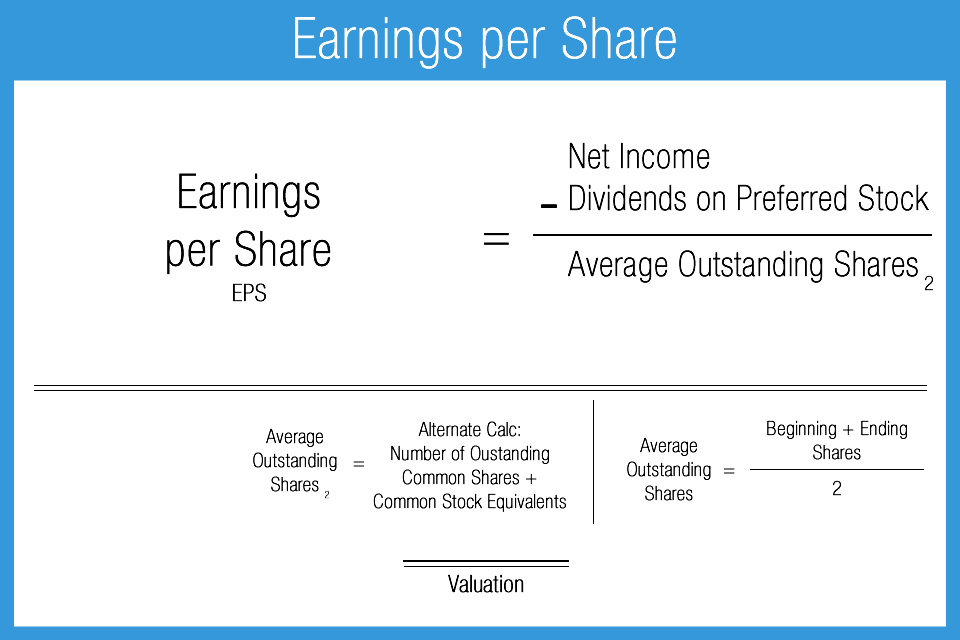

A more refined calculation adjusts the numerator and denominator for shares that could be created through options, convertible debt, or warrants. The numerator of the equation is also more relevant if it is adjusted for continuing operations. Holders of cumulative preferred shares are entitled to be paid current and past dividends (dividends in arrears) that the common shareholders have not paid. EPS is an important metric used to assess a company’s profitability from a fundamental perspective. But it’s only one part of the picture for assessing whether a stock is worth buying.

Company Earnings and EPS: Everything Investors Need to Know

Earnings season is the Wall Street equivalent of a school report card. It happens four times per year; publicly traded companies in the U.S. are required by law to report their financial results on a quarterly basis. Most companies follow the calendar year for reporting, but they do have the option of reporting based on their own fiscal calendars. Betting on an earnings beat basically means you think you know something that the best Wall Street analysts don’t know. A value investor might buy XYZ stock out of a belief that it is trading at a discount to its fair value, as demonstrated by the higher PE ratios of similar shoe companies. If most shoe companies have PE ratios around 20, and XYZ Shoe Company has a PE ratio of 15, then XYZ is 25% less expensive than its peers on an earnings basis.

- For example, a startup tech company with a lot of potential may have a lower EPS than an established healthcare company.

- For individuals who are unfamiliar with the term “professional business register,” it is critical to define such terms as “earnings” and “shares.”

- Typically, an average number is used because companies may issue or buy back stock throughout the year and that makes the actual outstanding shares and true earnings per share difficult to pin down.

- It is a tool that is used frequently by investors, but is by no means the only measure of a company’s financial future.

- A company relatively early in its growth curve could post negative earnings per share since it is investing now for future growth.

What is a good EPS?

To calculate a company’s earnings per share, divide total earnings by the number of outstanding shares. Earnings per share (EPS) is an important profitability measure used in relating a stock’s price to a company’s actual earnings. In general, higher EPS is better but one has to consider the number of shares outstanding, the potential for share dilution, and earnings trends over time.

Dividend payout ratio

A company relatively early in its growth curve could post negative earnings per share since it is investing now for future growth. A more mature company could simply have a bad year operationally (as many companies did during the novel coronavirus pandemic). An accounting charge related to a past acquisition (often referred to as a ‘writedown’) could erase profits and lead to a reported net loss. A large, one-time, litigation settlement can lead to a short-term spike in expenses.

Is there any other context you can provide?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Common shareholders have voting rights to elect the Board of Directors and pass (or reject) corporate policies brought to vote by shareowners.

There are several types of EPS including reported EPS, adjusted EPS, ongoing EPS, retained EPS, cash EPS, and book value EPS. Earnings per share, or EPS, is a simple calculation that shows how much profit a company can generate per share of its stock. For instance, if the company’s net income was increased based on a one-time sale of a building, the analyst might deduct the proceeds from that sale, thereby reducing net income. Rolling EPS gives an annual earnings per share (EPS) estimate by combining EPS from the past two quarters with estimated EPS from the next two quarters. Earnings per share can be distorted, both intentionally and unintentionally, by several factors.

For individuals who are unfamiliar with the term “professional business register,” it is critical to define such terms as “earnings” and “shares.” Earnings per share is an extremely vital business statistic used to entice, persuade, and demonstrate to investors the advantages of putting their money into a particular firm. Broader economic factors and industry trends can affect a company’s net income what is adjusted gross income and hence its EPS. Economic downturns, shifts in consumer behavior, or changes in regulation can impact EPS. Conversely, when a company repurchases its own shares, this can increase EPS by concentrating earnings among fewer shares. However, it’s important for investors to consider other financial indicators alongside EPS for a more comprehensive understanding of a company’s financial health.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. One of the first performance measures to check when analyzing a company’s financial health is its ability to turn a profit.

Additionally, analysts often use EPS when making recommendations about which stocks to buy or sell. There are a number of factors that can impact EPS, including the company’s revenue, costs, and share count. Changes in any of these factors can affect the company’s profitability and, consequently, its EPS. Regardless of its historical EPS, investors are willing to pay more for a stock if it is expected to grow or outperform its peers. In a bull market, it is normal for the stocks with the highest P/E ratios in a stock index to outperform the average of the other stocks in the index. To better illustrate the effects of additional securities on per-share earnings, companies also report the diluted EPS, which assumes that all shares that could be outstanding have been issued.