Whether you call it the accounting equation, the accounting formula, the balance sheet equation, the fundamental accounting equation, or the basic accounting equation, they all mean the same thing. At the same time, it incurred in an obligation to pay the bank. The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31. The balance sheet is also referred to as the Statement of Financial Position. When the total assets of a business increase, then its total liabilities or owner’s equity also increase. Since the balance sheet is founded on the principles of the accounting equation, this equation can also be said to be responsible for estimating the net worth of an entire company.

The relationship between the accounting equation and your balance sheet

For example, if you have a house then that is an asset for you but it is also a liability because it needs to be paid off in the future. On 28 January, merchandise costing $5,500 are destroyed by fire. The effect of this transaction on the accounting equation is the same as that of loss by fire that occurred on January 20. This transaction would reduce cash by $9,500 and accounts payable by $10,000. The difference of $500 in the cash discount would be added to the owner’s equity. On 10 January, Sam Enterprises sells merchandise for $10,000 cash and earns a profit of $1,000.

Would you prefer to work with a financial professional remotely or in-person?

It specifically highlights the amount of ownership that the business owner(s) has. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Assets

The shareholders’ equity number is a company’s total assets minus its total liabilities. Shareholder Equity is equal to a business’s total assets minus its total liabilities. It can be found on a balance sheet and is one of the most important metrics for analysts to assess the financial health of a company. As you can see, all of these transactions always balance out the accounting equation. This equation holds true for all business activities and transactions.

- It is sometimes called net assets, because it is equivalent to assets minus liabilities for a particular business.

- To make the Accounting Equation topic even easier to understand, we created a collection of premium materials called AccountingCoach PRO.

- Ted decides it makes the most financial sense for Speakers, Inc. to buy a building.

- Transaction #3 results in an increase in one asset (Service Equipment) and a decrease in another asset (Cash).

- The accounting equation is important because it allows the business or entity to correctly record transactions and, therefore, maintain their financial statements.

Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7. Accountingo.org aims to provide the best accounting and finance education for students, professionals, teachers, and business owners. Understanding how the accounting equation works is one of the most important accounting skills for beginners because everything we do in accounting is somehow connected to it. The global adherence to the double-entry accounting system makes the account-keeping and -tallying processes more standardized and foolproof.

Likewise, revenues increase equity while expenses decrease equity. If an accounting equation does not balance, it means that the accounting transactions are not properly recorded. In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business.

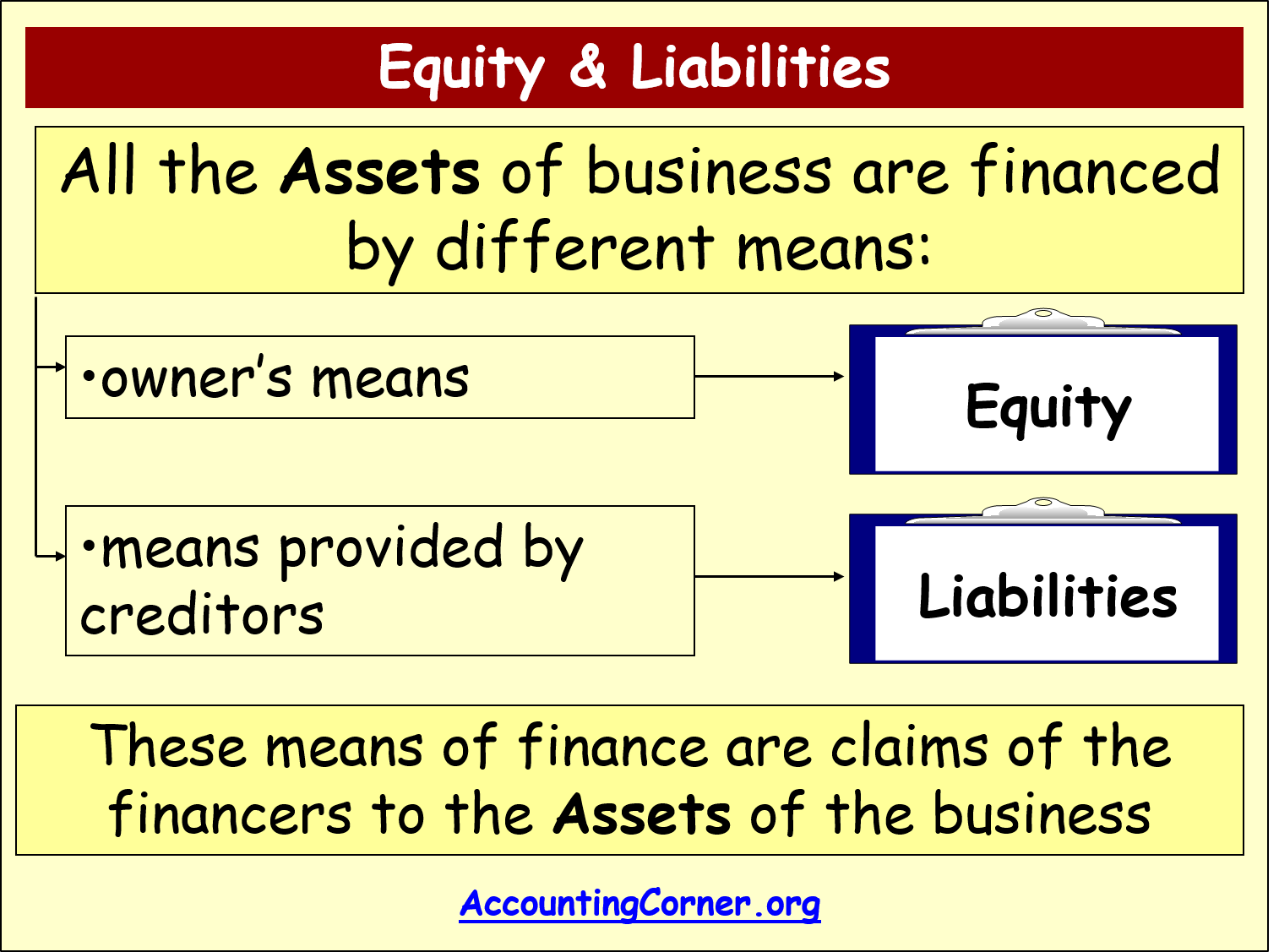

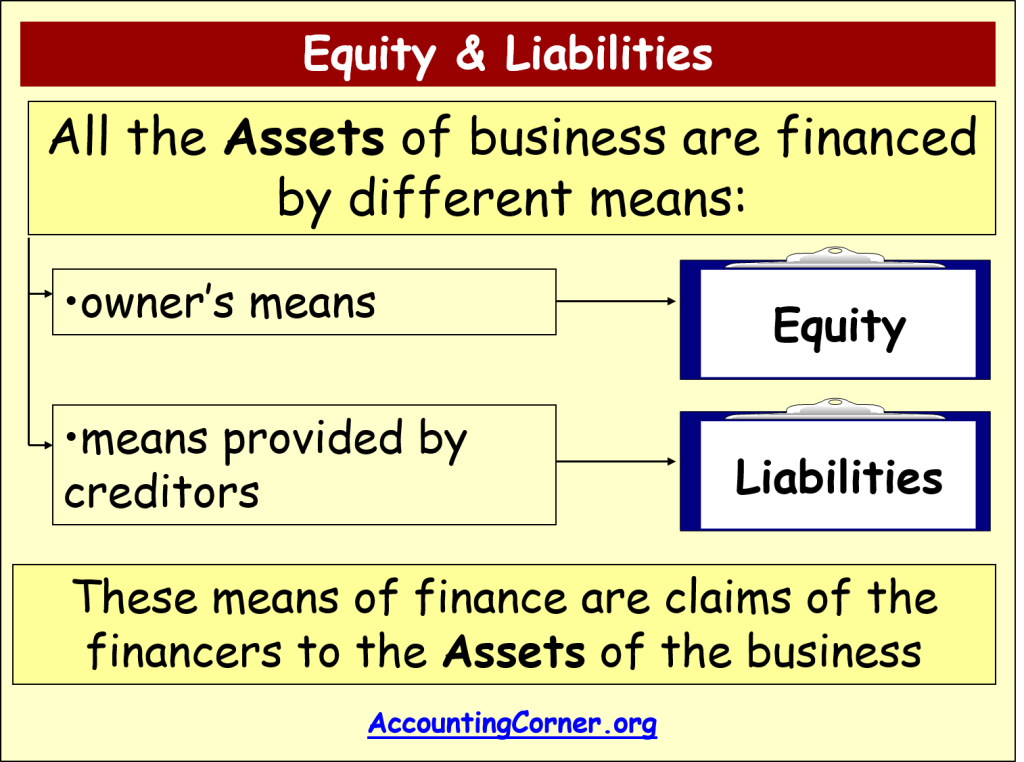

On the other hand, double-entry accounting records transactions in a way that demonstrates how profitable a company is becoming. Investors are interested in a business’s cash flow compared to its liability, which reflects current debts and bills. We know that every business holds some properties known as assets. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business.

If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. As its name implies, the Accounting Equation is the equation that explains the relationship of accounting transactions. The Accounting Equation states that assets equals the total of liabilities and equity.

(Note that, as above, the adjustment to the inventory and cost of sales figures may be made at the year-end through an adjustment to the closing stock but has been illustrated below for completeness). Before explaining what this means and why the accounting equation should always balance, let’s review the meaning of the terms assets, liabilities, and owners’ equity. These may include loans, accounts payable, mortgages, deferred revenues, bond issues, warranties, and accrued expenses. The accounting equation is also called the basic accounting equation or the balance sheet equation.

Assets typically hold positive economic value and can be liquified (turned into cash) in the future. Some assets are less liquid than others, making them harder to convert to cash. For instance, inventory third party business definition is very liquid — the company can quickly sell it for money. Real estate, though, is less liquid — selling land or buildings for cash is time-consuming and can be difficult, depending on the market.